Cambodia Tax Alert: ACAR Deadline for Submission of Financial Statements

On the 27th of December 2022 the Accounting and Auditing Regulator (“ACAR”) issued a reminder regarding the submission obligations relating to the 2022 financial statements of enterprises in Cambodia.

In summary enterprises that are not required to obtain an external independent audit of their 2022 financial statements are required to submit their 2022 financial statements to ACAR by the 15th of April 2023. For those enterprises requiring an external independent audit the submission date of their 2022 financial statements is the 15th of July 2023.

Detailed Summary

Pursuant to Royal Code No. NS/RK/0416/006, dated April 11, 2016, promulgating the Law on Accounting and Auditing, enterprises and non-profit organizations must perform the following obligations:

- Maintain accurate accounting records

- Prepare financial statements in accordance with applicable accounting standards within 3 months from the closing date

- Submit financial statements for independent audited enterprise by completing the independent audit work and publish the independent audit opinion no later than 6 months from the date of accounting close for enterprises and non-profit organizations subject to the requirements of performing independent audit obligations? as stated in Prakas No. 563 MEF Prak dated 10 July 2022 on the obligation to submit financial statements for independent audited enterprise.

More information on the requirements above can be found here.

In addition, in accordance with the provisions relating to the Law on Accounting and Auditing, all enterprises and non-profit organizations are obliged to submit their annual financial statements to ACAR on time depending on the type of enterprise or non-profit organization. To fully implement the obligation to submit financial statements for 2022 to ACAR successfully and on time for all enterprises (except for small taxpayers) and non-profit organizations, the following guidelines must be followed:

Non-audited enterprise and Non-Profit Entity

- Financial statements must be submitted to ACAR no later than 3 months and 15 days from the date of the accounting year end.

- A letter must be submitted requesting a change of the financial reporting identification number (FIN) from an independent audited enterprise to ACAR no later than 60 days from the date of accounting year end, in case the enterprise is subject to an independent audit for the 2022 accounting year.

Audited Enterprise and Non-Profit Entity

- The Financial Statements of the Independent Auditor prepared for the enterprise shall be submitted to ACAR no later then 6 months and 15 days from the date of the accounting year end.

- A letter must be submitted requesting a change of the financial reporting identification number (FIN) from a non-audited enterprise to ACAR no later than 60 days from the date of accounting year end, in case the enterprise is not subject to an independent audit for the 2022 accounting year.

Submission of the Financial Statements to ACAR

Enterprises can use the ACAR e-filing system to submit their annual financial statements which can be found at https://www.acar.gov.kh/.

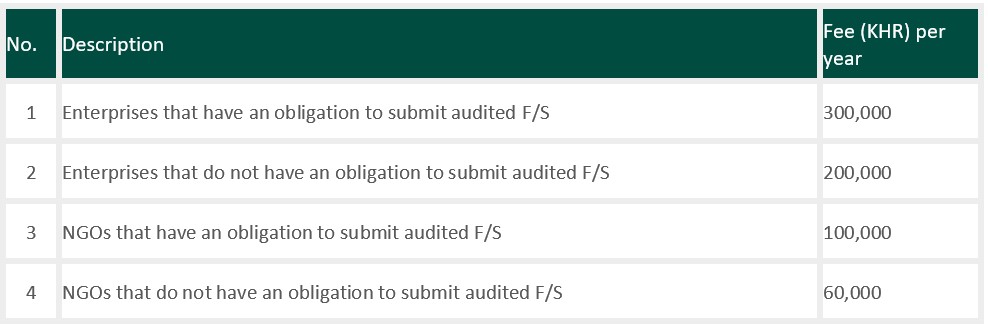

The public service fees to be paid for the retention of financial statements in accordance with Prakas No. 001 BBFSA dated 12 January 2022 are as follows:

Those enterprises that fail to submit their annual financial statements in time to ACAR as per Instruction 002 will be subject to penalties as provided in Sub-Decree no. 79 dated 1 June 2020. Sub-decree no. 79 prescribes a penalty of Khmer Riel 2 million (USD500) and Khmer Riel 1.5 million (USD375) for large and medium taxpayers respectively that fail to, or are late in, submitting their annual financial statements to ACAR.

ACAR can inspect the headquarters or offices of enterprises and entities as necessary in accordance with the Law on Accounting and Auditing and related regulations in force.

For more details, please contact the officials of ACAR via phone and telegram numbers below:

- Independent Audited Enterprise: 070 929 237/010 736 835/010 771 568

- Independent Non-Audited Enterprise: 093 919 192/070 545 688/089 508 567

- Entity: 081 644 663/085 444 488/089 508 567

- Others: 010 309 200

Tax services required to be undertaken by a licensed tax agent in Cambodia are provided by Mekong Tax Services Co., Ltd, a member of DFDL and licensed as a Cambodian tax agent under license number – TA201701018.

The information provided here is for information purposes only and is not intended to constitute legal advice. Legal advice should be obtained from qualified legal counsel for all specific situations.

Contacts

|

|

|

The post Cambodia Tax Alert: ACAR Deadline for Submission of Financial Statements appeared first on DFDL.

Link to article

Post a comment

Post a comment Print article

Print article