Cambodia Tax Alert: Clarification on Advance Tax on Dividend Distribution

by Ramandeep Singh Bhamra

“What’s in a name? That which we call a rose by any other name would smell just as sweet.”

– William Shakespeare

What’s in a name? From a Cambodian tax perspective, it would seem quite a lot. On the surface, Instruction 30408 “On the Implementation of Advance Tax on Dividend Distribution,” issued by the General Department of Taxation (GDT) on 14 December 2022 seems quite innocuous. Simply put, Advance Tax on Dividend Distribution (ATDD) is a mechanism under which Tax on Income (TOI) is calculated at the time when a Cambodian enterprise distributes pre-taxed earnings.

The key difference between ATDD, which was introduced in 2020, and its predecessor, Additional Tax on Dividend Distribution (ADDT), is that ATDD should only apply to distributions of earnings that have not yet been subject to an annual TOI rate – whereas, pre-2020, ADDT could have applied to both interim distributions and to distributions that had been subject to an annual TOI rate that was lower than the standard annual TOI rate of 20%.

This difference is fundamentally illustrated with respect to distributions made by Qualified Investment Projects (QIP). Prior to 2020, a QIP that distributed earnings, either by way of an interim dividend or on earnings that had already been subject to a annual TOI rate of 0% during the TOI exemption period, would have had to declare and pay 20% TOI via the ADDT mechanism.

Under the post 2020 ATDD mechanism, interim dividends distributed by a QIP during its TOI exemption period are not subject to ATDD and there is no claw-back of ATDD on the distributions of retained earnings that have been subject to a annual TOI rate of 0% during the TOI exemption period.

Instruction 30408 restates the rules contained in the Law on Taxation and Prakas on Tax on Income. To determine the tax base on which ATDD applies, the pre-taxed distribution must first be grossed up and then multiplied by the applicable annual TOI rate at the time of the distribution. The ATDD paid at the time of the distribution can be claimed as a tax credit in the annual tax computation of the enterprise.

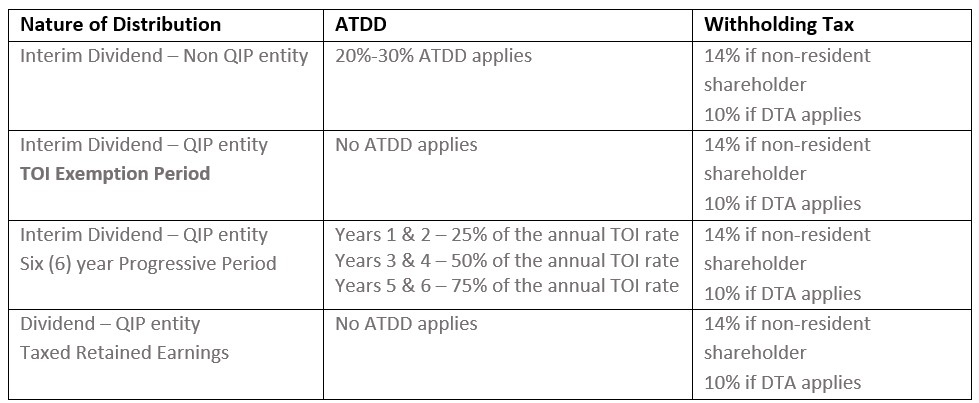

Instruction 30408 also takes into account the six (6) year progressive rebate on the annual TOI rate for QIPs, following the TOI exemption period, under the 2021 Law on Investment. The implications of Instruction 30408 are tabled below:

For those who are a little confused about these changes, we provide a crash-course below on the recent history behind ATDD and the key issues we believe Instruction 30408 addresses.

Analysis

Advance Tax on Dividend Distribution

ATDD was introduced in the 2020 Law on Financial Management, which amended the Law on Taxation and replaced the previous ADDT mechanism. As noted, ATDD is used to apply the applicable TOI rate at the time of a distribution of current year pre-taxed earnings. ATDD would most commonly apply when a Cambodian enterprise distributes an interim dividend from its pre-taxed current year earnings. This is illustrated in the example below:

Example:

Company A, which is subject to the standard annual TOI rate of 20%, has untaxed year-to-date earnings of USD 100,000 in the first half of 2023, which it distributes as a interim dividend in July 2023. The interim dividend distribution in July 2023 is subject to ATDD. ATDD is calculated by grossing-up the USD 100,000 interim dividend and then applying the applicable annual TOI rate:

(A) USD100,000/[1-(20/100)] = USD100,000/0.8 = USD125,000

(B) USD125,000 x 20%

(C) USD25,000

(A) = Gross up the distributed by the applicable annual tax rate

(B) = Multiply the grossed-up distribution to the applicable annual TOI rate

(C) = ATDD payable

The ATDD payable at the time of the interim dividend distribution needs to be manually declared/paid to the GDT by the 20th of the month following the distribution using Form T7 01(Return For VAT, VAT (State Charge), Accommodation Tax, Public Lighting Tax, Pre-payment of TOI, Specific Tax) under Item 7 in the Form – “Other Taxes.”

ATDD acts in a similar way to the Monthly Pre-payment of Tax on Income in that the ATDD can be claimed by the taxpayer as a tax credit in their annual TOI calculation to ensure that TOI is not calculated twice on the same taxable income.

Qualified Investment Projects

The way in which ATDD applies to the distributions of a QIP highlights its biggest difference with the pre-2020 ADDT mechanism. Under the current tax regulations, ATDD will not apply to pre-taxed distributions made by a QIP during its tax exemption period or to retained earnings that have already been subjected to an annual TOI rate. What that means in practice is that if a QIP enterprise distributes an interim dividend during its tax exemption period or distributes retained earnings that have been subject to an annual TOI rate of 0%, then ATDD will not apply to the interim dividend or distribution of taxed retained earnings.

Because ATDD only applies to pre-taxed earnings, a QIP that has had retained earnings subjected to an annual TOI rate of 0% (during its tax exemption period) will not be subject to any further TOI at the time of distribution of those retained earnings – regardless of whether the distribution is made during or after the TOI exemption period of the QIP enterprise. The exemption to ATDD also applies to the post 2020 distribution of retained earnings that benefited from an annual TOI rate of 0% during a TOI exemption period that occurred prior to 2020.

The 2021 Law on Investment added a new feature for those QIPs who elect to enjoy a TOI exemption (Option 1 under the 2021 Law on Investment). Under the 2021 Law on Investment, once the TOI exemption period has ended, a QIP is entitled to only declare and pay a percentage of the applicable annual TOI rate for a period of six (6) years (TOI Rebate Period).

If a QIP distributes an interim dividend during the TOI Rebate Period then the QIP will need to declare and pay ATDD at the time of the distribution at the effective TOI Rebate Rate, i.e., 25%, 50% or 75% of the applicable annual TOI rate (in most cases the applicable annual TOI rate would be 20%). As per above, to determine the tax base, the interim dividend will need to be grossed up by the TOI Rebate Rate and, once the ATDD has been declared and paid, it will be claimable as a tax credit in the annual TOI computation of the QIP.

The key point to note is that earnings made by a QIP during the TOI Rebate Period will be subject to a annual TOI rate which is then subject to a rebate in the annual TOI computation. As such, when calculating ATDD on an interim distribution during the TOI Rebate Period, only the applicable TOI Rebate Rate will apply. When a QIP distributes dividends from retained earnings that have been subject to a TOI Rebate Rate, no additional ATDD will apply.

Example:

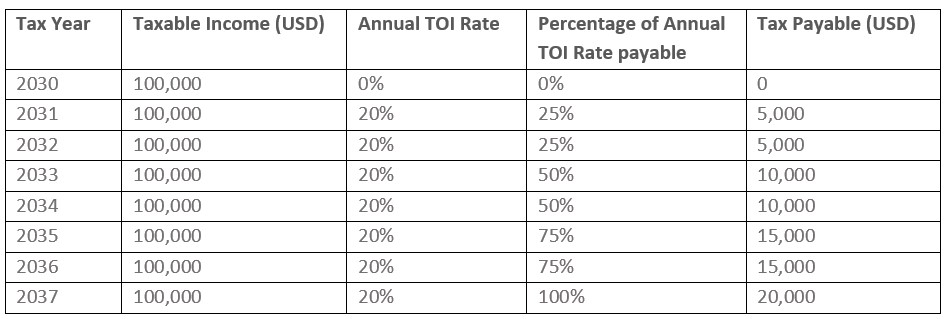

Enterprise A is registered as a QIP in 2023 and elects to receive the TOI exemption in the Law on Investment. The TOI exemption period for Enterprise A expires on 31 December 2030. In 2031 and 2032, Enterprise A is entitled to only pay 25% of its annual TOI liability (we assume that the standard 20% TOI rate applies). In 2033 and 2034, Enterprise A is entitled to only pay 50% of its annual TOI liability and in 2035 and 2036 Enterprise A is entitled to only pay 75% of its annual TOI liability. In 2037, Enterprise A would be subjected to the annual TOI rate of 20% with no rebate.

Assuming that from the years 2030 to 2037 Enterprise A makes annual taxable income of USD 100,000, the annual TOI payable of Enterprise A would look like this:

Withholding Taxes

It should be noted that in the cases outlined above, if a interim dividend or dividend from taxed retained earnings are made by a Cambodian enterprise to a non-resident shareholder then the Cambodian enterprise would still be obliged to withhold withholding tax (WHT), at the applicable rate, on the distribution.

The standard rate of WHT on the distribution of a dividend by a Cambodian enterprise to a non-resident shareholder is 14%. However, under most Double Tax Agreements (DTA) that Cambodia has signed, the WHT rate may be reduced to 10% on a dividend distribution provided that pre-approval from the GDT has been obtained.

For a non-QIP enterprise, subject to 20% TOI, the distribution of a dividend to a non-resident shareholder in a non-QIP jurisdiction would be subject to an effective tax rate of 31.2% (TOI + WHT) in Cambodia. For a QIP entity distributing retained earnings generated during its TOI exemption period to a non-resident shareholder who is a tax resident in a jurisdiction that has a DTA with Cambodia, the effective tax rate would be 10% (WHT) in Cambodia.

Tax Planning

The changes brought about by the introduction of the ATDD mechanism in 2020 and the new incentives in the 2021 Law on Investment highlight the potential for robust tax planning which ensures that incentives can be optimized without falling foul of the local tax authorities. Even with the apparent shield of these new incentives, it is important to ensure that a substance-over-form approach is adopted when choosing overseas jurisdictions to hold Cambodian investments, the introduction of inter-company transactions and related transfer pricing requirements, and the timing of dividend distributions.

The DFDL tax team has a vast depth of experience with regard to tax planning and, as always, we stand ready to answer any questions that you may have on this or other tax issues of concern.

Tax services required to be undertaken by a licensed tax agent in Cambodia are provided by Mekong Tax Services Co., Ltd, a member of DFDL and licensed as a Cambodian tax agent under license number – TA201701018.

The information provided here is for information purposes only and is not intended to constitute legal advice. Legal advice should be obtained from qualified legal counsel for all specific situations.

Contacts

Read more Legal & Tax Updates

Read more about DFDL

Read more about DFDL Cambodia

The post Cambodia Tax Alert: Clarification on Advance Tax on Dividend Distribution appeared first on DFDL.