Summary

When it comes to investment in different types of legal tech, it is clear governments are investing. However, when it comes to the type of tech and provider for, this can vary whether outsourced to an international, regional or domestic company and seems in some cases, there is a combination. In addition, GCs own companies are also investing in creating new tech solutions in-house vs hiring external providers.

'IF I'D LIVED IN ROMAN TIMES, I'D HAVE LIVED IN ROME.'

John Lennon's famous words when asked by a journalist why he was living in New York, then the cultural and economic centre of the world. In 2020, a growing number of tech investors that have relocated to Beijing are giving a similar answer.

President Xi Jinping has outlined a plan to make China a world leader in advanced technologies, investing more than a trillion dollars into key industries. Even without this state support, the country's tech sector is on an upward swing. Investment in its artificial intelligence (AI) sector for the first half of 2020 has already surpassed US$9bn, making China one of the leading global players in the field.

Following China's lead, tech companies across Asia have seen a boom in investment. Many of the region's fastest growing businesses - Hong Kong's WeLab, Singapore's Synagie, India's GoBolt - are led by charismatic, tech-savvy entrepreneurs.

The region's legal industry, often seen as a bastion of conservative values, is now waking up to the challenge of technology. Singapore now houses one of the largest legal tech accelerator programs in the world, Chinese courts have become world leaders in the use of technology, and even less mature markets have turned to technology as a way of bypassing their stretched legal systems.

To find out why the region is proving to be such a fertile ground for legal innovation, and how this is impacting in-house counsel, we speak to general counsel who are making the most of legal tech.

State aid

States across Asia Pacific are jostling for position, with substantial sums being spent by governments aiming to achieve legal technological pre-eminence. Already, legal tech initiatives region-wide have ridden on the crest of this wave. For example, Indonesia has made amendments to laws affecting legal tech, for instance by introducing a list of certified Indonesiane-signature providers. India has huge domestic demand for legal tech as it looks to boost efficiency in what is still mostly a pen and paper legal system.

Increasingly, the more established corridors of business are looking to capitalise on this success. Stung by the rising number of high-profile tech companies looking to list outside the region, the Singapore Exchange (SGX) has started offering grants to help fast growth businesses cover the legal and regulatory costs of their listings. In a similar move, Hong Kong's financial secretary Paul Chan Mo-po has set aside HK$50bn (US$6.5bn) in funding to support greater innovation and technology development in Hong Kong.

In April 2020, the Government of Hong Kong announced a HK$35m LAWTECH Fund to assist law firms and chambers upgrade their IT systems. As Jerrold Soh, assistant professor of computational law at Singapore Management University (SMU), explains:

'Hong Kong's approach is similar to Singapore's in that it is driven by external demand, but their focus is more on the mainland China market, especially technology related to the Belt and Road Initiative (BRI). For instance, a comprehensive electronic dispute resolution, arbitration and mediation platform was constructed out of Hong Kong to assist the BRI'.

Taken together, these initiatives suggest a regional trend, but the Asia Pafic tech market is anything but a unified field. It is, says Jerrold Soh, a market preoccupied with solving domestic rather than regional problems, and nowhere is this truer than in China.

'Domestic demand is the key driving force for Chinese tech companies, many of which are not so much interested in attracting outside investment. They really are just building their own topologies, and the same rule applies in the legal tech space.' 'There are so many new tech startups, firms and applications that are being built there. Not only are these companies becoming significant players, but they are changing the way we think about the law. You can have an entire dispute resolved on an app, powered by WeChat. That is something incredibly exciting in the legal field that is being driven by Chinese tech and innovation'.

While many of even the largest tech companies remain unknown outside the PRC, they boast user bases that would be the envy of a Silicon Valley unicorn. They are also becoming increasingly sophisticated, adds Ivy Wu, head of legal for Greater China at American business-to-business IT service provider DXC Technology.

'In the time I have observed the development of legal tech in China, I have found that in both litigation and non-litigation products the technology has developed amazingly fast. For nonlitigation software - for example, for document management and review tools - Chinese technology is now more advanced than anything available internationally. There are suppliers focusing on contract management processes and internal process approval on legal documents which have proved to be very effective, as has software aimed at the record keeping of signed agreements.'

Nancy Wei, head of legal for Skechers China, says the rapidly maturing domestic tech scene offers legal counsel greater flexibility when it comes to resourcing legal matters.

'We use a mix of both international and domestic Chinese technology in our team. For our database systems we use internationally known suppliers that have been active in the market for several years. However, for contract management we select local suppliers who may or may not have international experience, but who, in this area, tend to provide systems that are more user-friendly for the Chinese market'.

Kenji Tagaya, general counsel executive officer and head of the legal group at JERA, Japan's largest power generation company, says it is common for large organisations to look to both domestic and international providers.

'We introduced two [tech providers] for contractual review purposes, one English and one Japanese. I find this necessary as a Japanese solution is needed for Japanese-language documents and an international provider is needed for Englishlanguage documents.'

'Some international companies also claim that they have Japanese language adaptability, but the quality is limited because of the nature of AI. Unless they process a huge amount of data, the AI will not grow to a level of capability that satisfies us.'

A home-grown revolution

It is not just the rise of domestic tech firms that is changing the way GCs operate. Increasingly, legal teams across the Asia-Pacific region are looking to develop their own IT platforms before turning to external suppliers.

Carl Watson, general counsel for Asia at design and engineering consultancy Arcadis, underlines the value this brings to the legal team.

'What I would say is that you don't know what you don't have until you look... There's a whole volume of very helpful apps that you're paying for anyway, but you probably don't even know it; I've always been quite interested in what's available and then optimising these sorts of technologies.'

'Demonstrating value through use of simple technology tools to provide dashboard insight into what we're doing [is] how I got the ball rolling in the very early days. I think it's about building trust and identifying tools that were available without needing any great investment'.

Faz Hussen, general counsel and director of government relations at McDonald's Singapore, has found similar benefits in harnessing existing technology within the legal team.

'Using home-grown software has two main advantages. It is obviously much cheaper, and developing our own in-house software means that we can hedge on business costs as opposed to getting them signed off for external technology.'

Technology and the legal profession in Asia Pacific have long had a delicate relationship; while the potential impact of technology has long been understood - albeit oftentimes fodder for debate - its implementation and execution has, until recently, remained largely an academic exercise for most.

‘The practice of law is very much dependent on everyday life,’ explains Jane Toh Yoong San, partner at Shearn Delamore & Co.

‘With the growing use of technology all around the world, private practice law firms have been encouraged to use legal technology to keep up with the quickly changing nature of business and industry.’

Much like their in-house counterparts featured throughout the report, private practice lawyers have had to learn and adapt quickly to new working habits brought about by the pandemic - including the toolsets which facilitate remote legal work. For many, this marks a sharp departure from established norms - with much of the profession in Asia Pacific notoriously reticent on technology-driven shifts to legal practice. But for most in private practice, the global pandemic has meant that integrating technology has fast become a business imperative.

In-house clients are expecting that we have sufficient knowledge of the various technology tools available and how best to make use of them so that the successful delivery of legal services during the pandemic can be ensured,' explains Zhuowei (Joyce) Li, Partner at Han Kun Law Offices.

'Many expect that social distancing measures will be central to commercial thinking for years to come, making the effective use of technology a vital component for maintaining business relationships and offering the best service to our clients.'

That experience echoes the results of the empirical research which underpins this report, with technology becoming an increasingly important factor for in-house counsel when assessing their law firms, with 59% of respondents reporting that a firm's use of technology comprised a direct part of panel reviews and 68% saying that it was either very important or crucial that law firms remained abreast of new technologies. While some of that shift may be attributable to the short-term needs-driven innovation, few anticipate the uptake in technology to be a fast-passing trend.

'As service providers, we are naturally driven by client demand, and that demand will push law firms like ours to use more and better technologies in the coming years,' says Ahuja.

As US sanctions start to bite, businesses in the PRC are becoming ever more reliant on domestic technology. GC asks what it means for the country's lawyers:

If you want to build a nuclear powerplant, a maglev train, or a quantum computer it is increasingly likely you will rely on Chinese expertise. In the space of little more than two decades China has emerged as a global economic powerhouse, transforming itself from the home of low-cost manufacturing to a leader in cutting edge technologies.

Bin Zhao, senior vice president, legal and government affairs at tech multinational Qualcomm has seen China's technological prowess grow over two decades.

'Since late 1900s, China has started to highly promote the tech industry. The government made a lot of direct/indirect investments and extended a significant amount of polices in all business areas to advance Chinese technological development. That is when big multinational tech companies came into China and made business successes.'

'At that time, there was a honeymoon period between China and multinational companies, and American companies such as Microsoft, Intel and many others grew significantly during this period, taking advantage of both the open-door policy, and the Chinese leadership's good intentions to merge into the international market. The situation however has changed dramatically recently, and the tensions between the US and Chinese governments are making things much less clear.'

Dealing with this uncertainty is likely to be a key theme for the coming months. DXC Technology (DXC) is just one of a plethora of American companies operating in China that has felt the repercussions of ongoing trade wars.

'It is not something we can really prepare for,' says Ivy Wu, head of Greater China legal at DXC. 'Draft copies of regulations are coming out all the time, so we review to determine whether they will impact our business.'

'As in-house counsel we have to be fast acting, agile and knowledgeable in all aspects of laws in China. When a crisis happens, you need to keep in mind what kind of risk is associated, then you need to take some action, and manage all situations in a proper way.'

Indeed, escalating tensions between the United States and China have dominated news headlines in recent years. Chengyang Xie, vice president & chief legal officer at Foxconn Industrial Internet Co Ltd (FII), believes the potential decoupling between the United States and China is one of the chief concerns for in-house counsel in the region.

'When the trade war between the United States and China began to bite, we really saw things change. This year, the sanctions on Huawei and other entities have continued to be challenging, and there are now over 200 entities on that sanctions list. This will be a great challenge for the years to come. The one certainty is that everything is uncertain for multinational companies in China.'

Getting technical

Trade tensions aside, China's corporate counsel are finding themselves facing the same pressure to do more for less as US counterparts. While using technology to streamline processes has been on the radar of legal teams for some time, the recent COVID-19 pandemic has accelerated the need for new ways of delivering legal advice.

Gordon Liu, vice president, legal for Dell Greater China, says he has been fortunate in his ability to draw on a comprehensive suite of workplace technologies.

'Dell was a forerunner in workplace tech, so we have the infrastructure to work from a distance. Even before the pandemic, we were used to working in this way. However, systems that were somewhat experimental are now becoming our default way of working. For example, we use a contract management tool, which generates a lot of standard contracts, as well as handling negotiations, revisions and other changes. The pandemic has accelerated our use of these technologies, and our strong position in this field has allows us to navigate the lockdown without interruption.'

Adds Xie: 'The lockdown has taught us that remote teams can communicate just as effectively. In my regional cluster we handle business across 12 countries, so managing a legal team without faceto-face contact is something we are accustomed to. However, the enforced reliance on tech to conduct our daily business has been an interesting lesson to us all. We have seen that many matters are more efficiently processed with software.'

'Legal technology has become more important in the daily practice of in-house counsel. We now use tech-enabled platforms for legal drafts, intellectual property work and legal databases.'

Despite the advantages of legal tech, in-house have also experienced drawbacks, says Zhao: 'On one hand, internet-based, cloud-based and 5G smart

phone-enabled tools have significantly improved lawyers' efficiency. At the same time, when everybody is connected, and information and data is always flowing around, you have to be aware of the most current information and recent trends, and that is not easy.'

The innovation race

As China continues to support digital innovation and investment, corporate counsel find themselves under more pressure to evolve. Despite the challenges, in-house counsel across China have embraced tech to boost efficiency, connect legal teams and manage the ever-growing pressure to do more with less.

'The tech sector is a rapidly growing industry in China. There has emerged quite a few online, e-commerce and technology companies. With fast growth, there is a lot of energy volatility in the market,' says Liu.

However, as the domestic tech companies continue to develop in China, the future of international tech giants remains ambiguous.

'When talking about the future, the first word that jumps into my head is uncertainty,' says Zhao. 'I think that is the biggest challenge facing all multinational companies doing business in China.'

As Zhao puts it, the next few months will be decisive for multinationals in China: 'This is a very important point in history. We will have to wait and see what is going to happen after the US presidential elections. It will determine a new era of history for high-tech companies, and their future development in China.'

'Perhaps a bigger advantage is that internally developed technology can be customised to match systems we are already familiar with. That will ensure other business units can seamlessly work with the platform.'

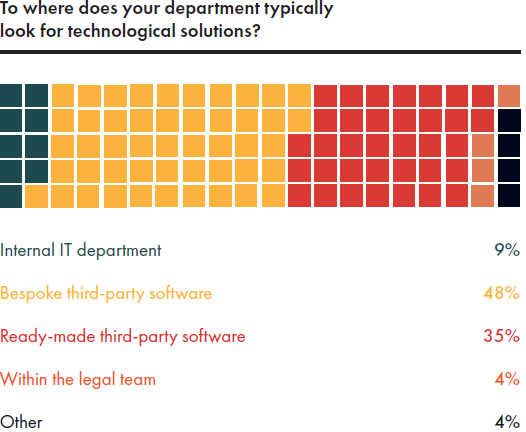

Turning to the results of our survey of over 100 legal teams across Asia Pacific, it seems that this message has yet to find a mass audience. Only 9% of legal teams are currently looking internally to develop tech solutions, while 83% of teams are looking to tech vendors for readymade or bespoke solutions.

Nonetheless, homegrown legal solutions are finding champions at the largest companies. Sheldon Renkema, general legal manager at top-10 ASX listed diversified conglomerate Wesfarmers, has worked to introduce a number of self-service tools into the legal department, including a non-disclosure agreement tool that allows commercial teams to generate and execute a compliant confidentiality agreement.

'Our objective is to identify processes that our lawyers would otherwise do that are not particularly complex and not particularly strategically significant. And where we can, making use of a tool so that can be done within the business in a userfriendly way that manages the risk'.

Creating tech solutions internally can also act as a catalyst for the creation of a culture of open-mindedness and creativity within teams, which can pay dividends in other areas. As Bernard Tan, Asia-Pacific managing counsel for US-headquartered analytical instrumentation manufacturer Agilent Technologies comments, 'It is important that we don't just follow corporate-wide technology projects. We need to create a culture of innovation and digitalisation within the legal function itself, and that means we need a sort of skunkworks for the legal team itself to develop and pioneer new tech.'

Chek-Tsang Foo, group deputy general counsel of NTT Limited, has followed this ethos, working with legal colleagues to create a suite of proprietary legal tech solutions, including a contract risk scoring tool for contracts. The next few years, he says, will be transformational for legal teams.

'Legal tech will not just change how fast we work, but what we work on. As technology matures, routine and repetitive work can effectively be automated. This frees up bandwidth for internal lawyers to do more complex work that requires more creativity.'

'It will allow us to spend much more time on things like negotiations, resolving complex matters and proactive legal risk management. The in-house team may also start to provide new areas of value to the enterprise, leveraging the legal team's skillsets and attributes. The future is also what we create, with the help of legal tech. Perhaps technology will help solve the modern in-house counsel's struggle for sufficient bandwidth.'

Inflection point

For GCs across the world, 2020 has been a year of learning to work remotely. As DXC Technology's Ivy Wu puts it:

'Covid-19 has totally changed people's lives and changed the way workplaces operate, and people have spent a long time adapting to a work from home lifestyle. This will have big implications for the uptake of legal technology.'

'In recent years, legal innovation has mostly benefited law firms and companies, but we are now seeing a trend toward traditional legal venues embracing technology. Courts are encouraging lawsuits to be filed online, and there is a push towards virtual hearings. Legal technology has made things more efficient for all players in the legal system, and those effects will continue to grow.'

JERA's Tagaya adds:'Until now, Japan has had a tendency to believe in paper, ink and physical signature or seal. But now that Covid-19 has forced companies to examine technological solutions and embrace non-traditional working practices, it may have opened up their eyes to the possibilities that technology provides, which will lead to a corresponding increase in demand and thus growth of this sector'.

Julien Bergerat, head of legal and chief compliance officer for Nghi Son Refinery and Petrochemical (NSRP), a joint venture to build and operate the largest petrochemicals refinery in Vietnam, is an old hand when it comes to working remotely.

Before moving to NSRP in 2019, he held senior positions in Kuwait, Qatar, Switzerland and France. The ability to access legal information on demand has now become an expectation, he says:

'We are living in a world where technology cannot be avoided, and the legal profession is no exception. Contract management, document automation and storage, legal research and, more recently, client relationship management and data and contract analytics tools are used by legal professionals as a matter of course'.

'Over the last decade, legal technologies have given the profession opportunities to improve its overall efficiency and the tools to adapt to agile and challenging working environments. The lower cost of hardware, improved ease of use of software and increased mobility have allowed for easier means of communication but, most importantly, they have enabled lawyers to work from almost any location extremely efficiently'.

But it is not just the demands of remote working that are changing the way legal teams operate. The pressure to do more with less, never far from the minds of GCs, has suddenly become one of the main priorities of businesses fighting to cut costs in a time of crisis.

Benjamin Teong, associate counsel for legal operations at Lazada, one of South East Asia's largest e-commerce companies, sees adapting to this change as an increasingly unavoidable part of managing a legal function.

'For in-house counsel, the scope of the work and its complexity is increasing, but we are being forced more and more to work with leaner teams and really maximize the manpower that we do have. There is pressure to achieve more creative and innovative outcomes for the company'.

'We have tools that are specifically geared toward ensuring that we work efficiently and avoid low-value work as much as possible. We have a workflow management tool, which tracks any work requests to the legal team, allowing us to manage it from the time that we receive the request until the request is fulfilled, and to prioritise issues that are more pressing'.

Off-the-shelf solutions

Across Asia Pacific, GCs are finding that the simplest technologies carry the most impact when it comes to changing the way their teams operate. For Dimas Nandaraditya, general counsel of Indonesia-based Traveloka Group, this relatively simple software has proved to be a quiet revolution.

'Adopting a new technology requires time and managing multiple vendors and software for our business processes can be cumbersome, therefore we prefer out-of-the-box solutions.'

'We adopted software that sends regular reminders on when a contract or license is due to expire, which means lawyers no longer need to go through all documents one by one to assess the relevant expiry date or manually send reminders to the relevant stakeholders. The technology itself is rather simple but its impact is very significant: it makes our lives easier'.

There is, adds Nandaraditya, a degree of skepticism toward more advanced forms of legal tech, such as machine learning. 'Basic AI functions such as e-discovery or automated diligence are starting to get traction, but I doubt that they will be widely available in the next one to two years.'

Jeremy Ryan Chua, general counsel of JAC Liner Group, one of the largest bus companies in the Philippines, has a similar take: 'Artificial intelligence can assist in gathering data and narrow down possible decision-making choices, it cannot replace the intuition, on the ground experience, and foresight of a seasoned lawyer'.

Perhaps unsurprisingly then, while the potential of advanced legal tech continues to excite the region's GCs, it has so far failed to gain any real traction in legal teams. Josh Lee Kok Thong, chair of Asia Pacific wide legal tech forum ALITA, remains optimistic.

'The technology is really improving. One example is ROSS Intelligence, which recently rolled out a free Google Chrome extension. Users can plug in the case that they want to review, and the system will instantly pull it out. Tools like this will change how in-house counsel behave.'

'The next generation of AI technologies will help lawyers start to write and craft opinions. This will be a game changer because it helps spark the inspiration process, it eliminates writer's block and enhances the cognitive abilities of lawyers. Building on this, the technology is a game changer. It will allow lawyers to gain new ways of thinking and new insights they may not have seen before.'

This should come as no surprise. As Per Hoffman, vice president and head of legal affairs and sourcing for North East Asia at Ericsson, comments:

'China is huge, so when it does something the volume it does it with and the impact that has on markets are all huge. AI will be the thing that will come into legal areas. Today you have contract databases where you can search and find various contract clauses. But the next step after that will be AI. China has one of the most advanced AI research and development environments in the world, so for lawyers that is the place we will look to for change.'